Наши конференции

В данной секции Вы можете ознакомиться с материалами наших конференций

II МНПК "Спецпроект: анализ научных исследований"

II МНПК"Альянск наук: ученый ученому"

I Всеукраинская НПК"Образовательный процесс: взгляд изнутри"

II НПК"Социально-экономические реформы в контексте европейского выбора Украины"

III МНПК "Наука в информационном пространстве"

III МНПК "Спецпроект: анализ научных исследований"

I МНПК "Качество экономического развития"

III МНПК "Альянс наук: ученый- ученому"

IV МНПК "Социально-экономические реформы в контексте интеграционного выбора Украины"

I МНПК "Проблемы формирования новой экономики ХХI века"

IV МНПК "Наука в информационном пространстве"

II МНПК "Проблемы формирования новой экономики ХХI века"

I НПК "Язык и межкультурная коммуникация"

V МНПК "Наука в информационном пространстве"

II МНПК "Качество экономического развития"

IV МНПК "Спецпроект: анализ научных исследований"

ІІІ НПК "Образовательный процесс: взгляд изнутри"

VI МНПК "Социально-экономические реформы в контексте интеграционного выбора Украины"

МНПК «Проблемы формирования новой экономики ХХI века»

IV МНПК "Образовательный процесс: взгляд изнутри"

IV МНПК "Современные проблемы инновационного развития государства"

VI МНПК «Наука в информационном пространстве»

IV МНПК "Проблемы формирования новой экономики ХХI века"

II МНПК студентов, аспирантов и молодых ученых "ДЕНЬ НАУКИ"

VII МНРК "Социально-экономические реформы в контексте интеграционного выбора Украины"

VI МНПК "Спецпроект: анализ научных исследований"

VII МНПК "Наука в информационном пространстве"

II МНК "Теоретические и прикладные вопросы филологии"

VII МНПК "АЛЬЯНС НАУК: ученый - ученому"

IV МНПК "КАЧЕСТВО ЭКОНОМИЧЕСКОГО РАЗВИТИЯ: глобальные и локальные аспекты"

I МНПК «Финансовый механизм решения глобальных проблем: предотвращение экономических кризисов»

I Международная научно-практическая Интернет-конференция «Актуальные вопросы повышения конкурентоспособности государства, бизнеса и образования в современных экономических условиях»(Полтава, 14?15 февраля 2013г.)

I Международная научно-практическая конференция «Лингвокогнитология и языковые структуры» (Днепропетровск, 14-15 февраля 2013г.)

Региональная научно-методическая конференция для студентов, аспирантов, молодых учёных «Язык и мир: современные тенденции преподавания иностранных языков в высшей школе» (Днепродзержинск, 20-21 февраля 2013г.)

IV Международная научно-практическая конференция молодых ученых и студентов «Стратегия экономического развития стран в условиях глобализации» (Днепропетровск, 15-16 марта 2013г.)

VIII Международная научно-практическая Интернет-конференция «Альянс наук: ученый – ученому» (28–29 марта 2013г.)

Региональная студенческая научно-практическая конференция «Актуальные исследования в сфере социально-экономических, технических и естественных наук и новейших технологий» (Днепропетровск, 4?5 апреля 2013г.)

V Международная научно-практическая конференция «Проблемы и пути совершенствования экономического механизма предпринимательской деятельности» (Желтые Воды, 4?5 апреля 2013г.)

Всеукраинская научно-практическая конференция «Научно-методические подходы к преподаванию управленческих дисциплин в контексте требований рынка труда» (Днепропетровск, 11-12 апреля 2013г.)

VІ Всеукраинская научно-методическая конференция «Восточные славяне: история, язык, культура, перевод» (Днепродзержинск, 17-18 апреля 2013г.)

VIII Международная научно-практическая Интернет-конференция «Спецпроект: анализ научных исследований» (30–31 мая 2013г.)

Всеукраинская научно-практическая конференция «Актуальные проблемы преподавания иностранных языков для профессионального общения» (Днепропетровск, 7–8 июня 2013г.)

V Международная научно-практическая Интернет-конференция «Качество экономического развития: глобальные и локальные аспекты» (17–18 июня 2013г.)

IX Международная научно-практическая конференция «Наука в информационном пространстве» (10–11 октября 2013г.)

Osipov D.V., Scherbakova M.V.

Astrakhan State University , Russian

NATIONAL DIAMOND OF ITALY AS A NECESSARY CONDITION FOR DEVELOPING TOURISM CLUSTER

In economics, the law of comparative advantage refers to the ability of a party (an individual, a firm, or a country) to produce a particular good or service at a lower opportunity cost than another party. It is the ability to produce a product with the highest relative efficiency given all the other products that could be produced [2].

Traditionally, economic theory mentions the following factors for comparative advantage for regions or countries: land, location, natural resources (minerals, energy), labor, and local population size. As far as these 5 factors can hardly be influenced, this fits in a rather passive (inherited) view regarding national economic opportunity [4].

Porter says that sustained industrial growth has hardly ever been built on above mentioned basic inherited factors. Abundance of such factors may actually undermine competitive advantage! He introduces a concept called "clusters" or groups of interconnected firms, suppliers, related industries, and institutions, that arise in certain locations. According to Porter, as a rule competitive advantage of nations is the outcome of 4 interlinked advanced factors and activities in and between companies in these clusters: FACTOR CONDITIONS (a country creates its own important factors such as skilled, resources and technological base; these factors are upgraded / deployed over time to meet the demand; local disadvantges force innovations, new methods and hence comparative advantage), DEMAND CONDITIONS (a more demanding local market leads to national advantage; a strong trend setting local market helps local firms anticipate global trends), RELATED AND SUPPORTING INDUSTRIES (local competition creates innovations and cost effectiveness, this also puts pressure on local suppliers to lift their game), FIRM STRATEGY, STRUCTURE AND RIVALRY (local conditions affect firm strategy; local rivalry forces firm to move beyond basic advantages), THE DIAMOND AS A SYSTEM (the effect of one point depends on the others; it is a self-reinforcing system [1].

This paper is devoted to research of the National Diamond of Italy as a necessary condition for developing tourism cluster

The Italian Republic or Italy is a southern European country, comprising a boot-shaped peninsula and two large islands in the Mediterranean Sea: Sicily and Sardinia . It shares its northern alpine boundary with France , Switzerland , Austria and Slovenia . The capital of Italy is Rome . Its area is 301,318 sq km and population of 59.13m – mostly Italian, with small populations of German, French and Slovene Italians in the north and Albanian-Italians and Greek-Italians in the south. Italy consists of 15 regions and 5 autonomous regions. The climate in Italy is highly diverse and can be far from the stereotypical Mediterranean climate depending on the location.

Parliament of Italy has a bicameral system composed of a Senate and a Chamber of Deputies. Both are directly elected and are of equal authority. The Constitution provides for the election of the Head of State (who is not politically aligned) for a seven-year term by an electoral college, consisting of the two Houses of Parliament and delegates from each region. The President can dissolve one or both houses of Parliament after consultation with the Speakers. Prime Minister is elected for a 5-year mandate.

At the end of the century, Italy joined the single currency of the EU, adopting the euro in 1999. Italy is Founding member of the North Atlantic Treaty Organisation (NATO) in 1949, Founding member of the European Community (precursor of the European Union) in 1957. Italy held the Presidency of the EU from July 2003 to December 2003, Member of United Nations and the G8.

First of all, it’s necessary to describe P olitical , Social and Economic Development. Italy became a nation-state belatedly – in 1861 when the city-states of the peninsula, along with Sardinia and Sicily , were united under King Victor Emmanuel. An era of parliamentary government came to a close in the early 1920s when Benito Mussolini established a Fascist dictatorship. His disastrous alliance with Nazi Germany led to Italy ’s defeat in World War II. Economic reconstruction after World War II was followed by unprecedented economic growth between 1950 and 1963. Gross domestic product (GDP) rose by an average of 5.9 percent annually during this time, reaching a peak of 8.3 percent in 1961. The years from 1958 to 1963 were known as Italy ’s economic miracle. The growth in industrial output peaked at over 10 percent per year during this period, a rate surpassed only by Japan and West Germany . The country enjoyed practically full employment, and in 1963 investment reached 27 percent of GDP. From the very beginning, Italy was an enthusiastic proponent of European integration, which has favoured the Italian manufacturing industry, which expanded enormously during this period. The economy slowed down after 1963 and took a downturn after the 1973 increase in petroleum prices. By the late 1980s, however, it was again prospering. The economy entered the mid-1980s with a healthy growth rate, which it maintained through the end of the century. Inflation reached nearly 22 percent in 1980. This was principally due to union strength in wage bargaining throughout the 1970s and a mechanism called the scala mobile. The high degree of job security enjoyed by the Italian workforce raised production costs, which in turn contributed to inflation. Beginning with a decree in 1984 that imposed a ceiling on payments, the scala mobile was gradually dismantled (and abolished in 1992). This was reflected in a sharp fall in inflation to 12 percent in 1984 and down to 4.2 percent in 1986. However, a three-year contract signed in 1987 between Confindustria and trade unions representing all civil servants and some private industrial workers awarded pay raises over the rate of inflation, and by 1991 inflation was again up to 7 percent—3 percent higher than in Germany or France. In 2000 inflation in Italy was at 10 percent. Overall, however, the inflation rate was three times smaller throughout the 1990s than in the 1980s.

The Italian economy is mixed, and until the beginning of the 1990s the state owned a substantial number of enterprises. At that time the economy was organized as a pyramid, with a holding company at the top, a middle layer of financial holding companies divided according to sector of activity, and below them a mass of companies operating in diverse sectors, ranging from banking, expressway construction, media, and telecommunications to manufacturing, engineering, and shipbuilding. Many of these companies were partly owned by private shareholders and listed on the stock exchange. By the 1980s moves had already been made to increase private participation in some companies.

Italy ’s public debt grew steadily throughout the 1980s despite a series of emergency measures designed to reduce public borrowing. By 1991 public debt exceeded GDP, and the cost of servicing it was more than $100 billion, accounting for the entire government budget deficit for the year. At the turn of the 21 st century, Italy ’s public debt still exceeded GDP. During the 1990s the annual GDP growth rates were very modest. In 2000, in response to a healthy international economy and to steps taken to improve the Italian finance system—including reduced public spending and increased taxation—the GDP grew 3 percent, its biggest increase since 1988, but it was unclear whether this recovery would be sustained.

Persistent problems include illegal immigration, the ravages of organized crime, corruption, high unemployment, and the low incomes and technical standards of southern Italy compared with the more prosperous north.

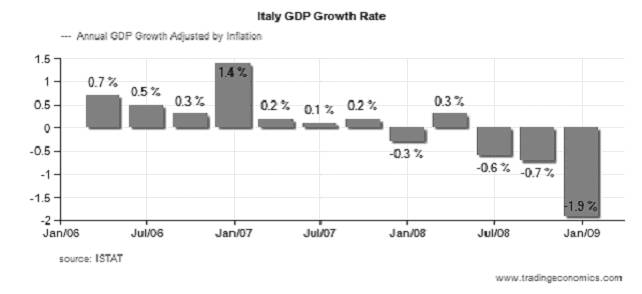

What about economic performance, Italy is one of the 65 high-income economies of the world with GDP on purchasing power parity of Italy is $1.801 trillion with percent change of 2.27 % ( 2007- 2008). On this point Italy is the tenth country in rank. The official exchange rate of GDP is $2399 billions with percent change of 10.71 % (2007-2008) . GDP – real growth rate is unfavorable (pic.1).

Italy ’s recent growth has been low for European standards, as the economy is troubled with the persistent problems of illegal immigration, organized crime, corruption, high unemployment, and the low incomes and technical standards of southern Italy compared with the prosperous north. GDP – per capita (PPP) is $31,000 with percent change of 1.88 % (2007-2008) and Italy is placed 42 in GDP – per capita (PPP) countries rank after France, Greece, Germany, Finland and etc. The average salary of people living in the south is about 75% of what it is in the north. The gap is even more extreme a regional level, with an average income in Lombardy of 32,000 euros (north) compared to 21,000 euros in Sicily (south).

Fig. 1. GDP Growth Rate [6]

The HDI (The Human Development Index) for Italy is 0.945, which gives the country a rank of 19 th out of 179 countries. According to this Index that looks beyond GDP to a broader definition of well-being Italy has strong positions in Life expectancy at birth (10 th place, 80.4 years), Adult literacy rate ( 21th place, 98.8%), Combined primary, secondary and tertiary gross enrolment ratio (22 nd place, 91.8%).

Labour force of Italy composes 25.09 million according to World Factbook (2008) and it is approximately 43% of population, and unemployment is totaled 6.8% (ranked 84 out of 200). Italy is above the European average for overall indicators in terms of quality of the workforce and labour productivity. Italian performance is much higher than the EU-27 average, higher than Sweden and Switzerland , and higher by 20% to Spain ’s average. Employment by branch ( 1995-2006, % volume) can be seen in charts below (fig. 2). According to them Italy is a developed country with growing employment in service sector.

Fig. 2. Employment by branch

Italy ’s export is $ 566.1 billion (2008) and the country is ranked 6 after Germany , Chine , USA , Japan and France . It is approximately 30.93% of country’s GDP. Italy ’s import is 566.8 billion (2008) and the country is ranked 7 after USA , Germany , Chine , France , Japan and UK . It is approximately 30.97% of country’s GDP. Main export partners of Italy are Germany 12.9%, France 11.4%, Spain 7.4%, US 6.8%, UK 5.8% (2007). Main import partners of Italy are Germany 16.9%, France 9%, China 5.9%, Netherlands 5.5%, Belgium 4.3%, and Spain 4.2% (2007). Italy is a member of EU and there are no customs and trade borders within EU and the reason of industry placing in the country is its efficiency and productivity.

According to ISTAT data, in 2002, there have been signs of export decline. Italy and its regional institutions are faced with significant challenges, especially since the recourses that fuel innovation are among the weakest in OECD countries, and since many manufacturing activities are moving to countries with cheaper labour.

Italy ’s investments (gross fixed) are 20.5 % of GDP, ranked 103 out of 150.

In accordance with the Financial Development Index 2008 Rankings Italy is placed 22 out of 52 of the world’s leading financial systems with the score 4.38. The development of financial systems is a key factor of economic growth. Seven pillars distributed among three categories of financial development are stable in Italy that provides such good positioning in ranking. F actors, policies, and institutions are the “inputs” that allow the development of financial intermediaries, markets, instruments and services. These inputs are represented by Institutional environment (26 th place, Score 4.66), Business environment (29 th place, Score 4.63) and Financial stability (24 th place, Score 4.82). Financial intermediation corresponds the variety, size, depth, and efficiency of the financial intermediaries such as Banks (16 th place, Score 4.41) and Non-banks (14 th place, Score 3.35) and Financial markets (15 th place, Score 3.83) that provide strong financial services. Capital availability and access that gives Italy with its Score 4.97 the 25 th place are the “outputs” of financial intermediation as manifested in the size and depth of the financial sectors and the availability of, and access to, financial services.

According to the Inward FDI Performance Index 2007 Italy is ranked 107, but the Inward FDI Potential Index places the country on the 31 st position. Outward FDI Performance Index places Italy on the 28 th position. So According to the World Investment Report 2008 Inward FDI flows totaled 40199 and 9.1 % of gross fixed capital formation, and Outward FDI flows totaled 90781 $ mln and 20.5 % of gross fixed capital formation.

Italy is placed 33 in t he Enabling Trade Index 2008 Ranking (with Score 4.70), provided be such sub indexes as Market access, Border administration, Transport and communications infrastructure and Business environment.

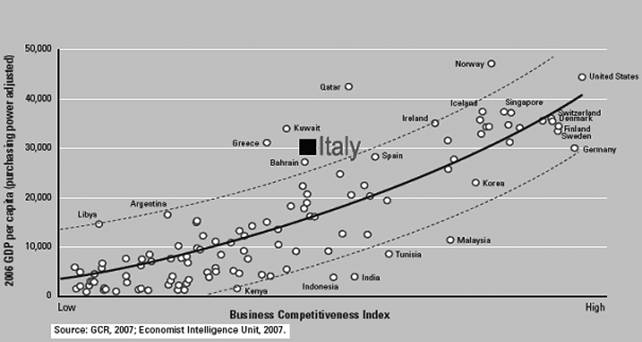

In Accordance with Business Competitiveness Index Italy is among the countries where the gap between the expected and the actual national business environment is highest; their business environments are significantly worse than expected given the sophistication of their companies (fig.3). Italy has registered the weakest medium term dynamism of all high-income countries, though recent performance has changed the trend.

Among high-income countries, Greece and Italy register the highest overperformance . Both countries are most likely benefiting from their position in the European Union (EU), which provides market access and financial transfers. The position of both countries still looks precarious for the medium-term future.

Industrial north, dominated by private companies, and a less-developed, welfare-dependent, agricultural south, with high unemployment. The Italian economy is driven in large part by the manufacture of high-quality consumer goods produced by small and medium-sized enterprises. Italy also has a sizable underground economy, which by some estimates accounts for as much as 15% of GDP. Italy has moved slowly on implementing needed structural reforms, such as lightening the high tax burden and overhauling Italy ’s rigid labor market and over-generous pension system and these conditions will be exacerbated by the recent global financial crisis. The Italian government is seeking to rein in government spending, but the leadership faces a severe economic constraint: Italy’s official debt remains above 100% of GDP 103.7% of GDP World Factbook data 2008 , and the fiscal deficit – 1.5% of GDP in 2007 – could approach 3% in 2009 as political pressure to stimulate the economy and the costs of servicing Italy’s debt rise. The economy will continue to contract through 2009 as the global demand for exports drop.

Fig. 3. Business Competitiveness Index [3]

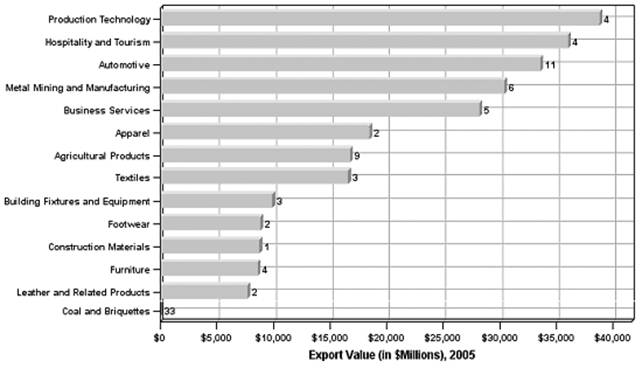

Italy ’s economy is dominated by the following large clusters – production technology, hospitality and tourism, automotive, metal mining and manufacturing, business services clusters (2005).

Hospitality and tourism was valued at $ 36 076, 91 ml (2005).

At the first sign there is a strong environment for cluster development and existence in Italy . According to the 2008-2009 Global Competitiveness Report, Italy obtained a ranking of 49 out of 134 countries (Score 4.4 out of 7), and 18 in Continental Europe and 18 in EU. Italy is an innovation-driven economy. The size of the market (9/5.6), business sophistication (21/5.0) with state of cluster development of 4, health and primary education (30/6.0), technological readiness (31/4.5), higher education and training (44/4.4) obtain strong marks and create conditions for growth. Italy has relative good scores on infrastructure (54/3.9), innovations (53/3.4), goods market efficiency (62/4.2), which provide conditions for growth, but these indicators should be improved. According to the 2008 Financial Development Report, Italy obtained a ranking of 22 out of 52 countries. Pillars in Financial intermediation and Capital availability and access show good figures and prove the stability of economy.

Fig. 4. Industry Export Value [3]

However, Italy lags other countries in some important areas. Efficiency in the labour market (126/3.6) and macroeconomic stability (100/4.5) are significant constraints for business. In these two pillars uneven performance is observed. Firing costs (GCR rank: 5) and inflation (GCR rank: 21) are strong; high and firing practices (GCR rank: 134), flexibility of wage determination ( GCR rank: 129), pay and productivity (GCR rank: 131), government debt (GCR rank: 123) are weak. It may be explained by ineffective work of government institutions. All these positions result in misbalance and unequal growth of business.

Quality of education in Italy is good. Italy has a GCR ranking of 45 in terms of quality of primary education, 69 in terms of the quality of math and science education. Italian student are developing their technical skills, but the process is not so effective. More close collaboration between universities and industries should be achieved to improve development of students technical and math skills.

Universities in Italy have a very insular role, do not interact with the public sector, nor do they have any impact on growth of innovation clusters. The data concerning patents, as strong indicators of innovation capacity, present an interesting asymmetry between a weak innovative capacity and high research effectiveness.

In terms of institutions, Italy has poor figures. Italy operates within a culture of bureaucracy. Public trust of politicians are weak (GCR rank: 92), regulation of government is burdensome (GCR rank: 130), government spending are wasteful (GCR rank: 128) and the legal framework is inefficient (GCR rank: 114).

Italy is perceived as a dangerous place. Organized crime is high (GCR rank: 124), at the same time reliability of police services (54), and business costs of crime and violence (73) are good. It may cause some obstacles of doing business. Rank of organized crime is seriously high but stereotype of Italian mafia adds some points to this indicator. Despite the high level of organized crime, corruption in Italy is relatively low. In accordance with the 2008 CORRUPTION PERCEPTIONS INDEX the country ranks 55 out of 180.

In accordance with the Ease of Doing Business rank (2009) (fig.5) Italy is placed 65 out of 181. The main challenges are duration of obtaining necessary documents (licenses, permits, required notifications); number of payments (taxes) the entrepreneur must take; duration, cost of lawsuits.

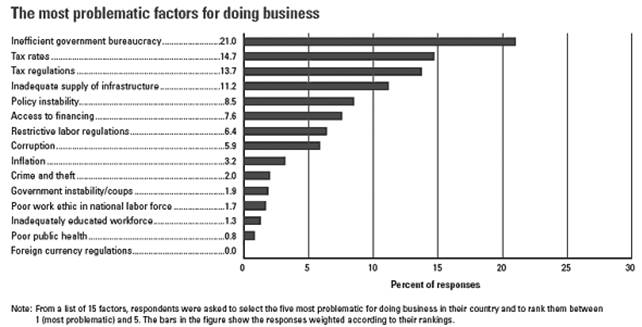

The most problematic factors for doing business shown in the 2008-2009 Global Competitiveness Report are inefficient government bureaucracy, tax rates, tax regulations, inadequate supply of infrastructure (fig.6).

Fig. 5. Ease of Doing Business ( Italy ) [5]

Fig. 6. The most problematic factors for doing business [ 7 ]

In 2008 Gender Gap Index Italy ranks 67 out of 130. The gender empowerment measure (GEM) reveals whether women take an active part in economic and political life. It tracks the share of seats in parliament held by women; of female legislators, senior officials and managers; and of female professional and technical workers- and the gender disparity in earned income. This index reflects economic independence. The GEM exposes inequality in opportunities in selected areas. Italy ranks 21 st out of 108 countries in the GEM, with a value of 0.734.

The GCR ranks Italy 53 in term of innovation. Italy has strong positions in capacity for innovation (22), utility parents (25), availability of scientists and engineers (45). It is also proved by intellectual property protection ranking of 42.

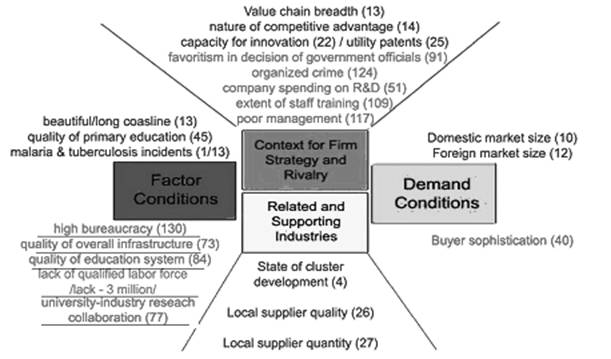

Using the Global Competitiveness Report [7] the attempt to outline the National Diamond of Italy (fig.7).

Fig. 7. National Diamond of Italy

Factor conditions. Italy has strong factor conditions in Malaria incidence, Mobile telephone subscribers, Life expectancy, Infant mortality, Quality of primary education, Available seat kilometers, Business impact of tuberculosis, Tuberculosis incidence, Telephone lines and others. Such conditions as the absence of malaria incidence and small number of touberculosis incidence, beautiful and long coastline create friendly environment for tourist coming in the region, while infrastructure of roads, air transport and even ports are lagging. Such strong indicators as life expectancy infant mortality, quality of primary education prove that Italy is an advanced country. Besides Italy has highly developed telecommunications that provides favorable base for doing business.

However the country is currently lacking in burden of government regulation, reliability of police services and judicial independence, these indicators are rather significant for business growth and development. In spite of high positions in quality of primary education, the quality of the educational system, management schools, math and science education, and scientific research institutions, university-industry research collaboration are poor. All these result in small quantity of highly skilled workers. Ease of access to loans , venture capital availability and financial market sophistication put the brakes on the economy.

Demand Conditions. This is one of the strongest links in Italy ’s national diamond. Buyer sophistication is high enough in Italy . Buyers demand is a relatively high standard for product quality and there are strict laws and regulations to protect a customer’s well being. Fair indicators of domestic and foreign market size prove advantageous demand conditions. Nevertheless the government should take more active part in procurement of advanced tech products.

Context for Firm Strategy and Rivalry. Italy has improved position of innovation capacity – one of the main indicators of competitiveness growing. Nature of competitive advantage, production process sophistication and breadth of value chain in the country are rather high, although Italy should create local areas which stimulate competitiveness and intensify local competition. Minority shareholders’ interests need to be increased significantly. Italy also shall develop more efficient forms of labor -employer cooperation and indicate new ways of staff training. Italian business shall review its approach to management providing more efficient environment.

Italy is still lagging behind regional benchmarks in terms of its ease of doing business, with significant gaps in areas such as receiving construction permits, getting credit, enforcing contracts. As another regulatory constraint, the tax system has been described as burdensome, and is also listed as an ? “ease of doing business constraint.” Favoritism in decisions of government officials, inefficient legal framework, government bureaucraticy , level of organized crime inhibit competitiveness and discourages domestic and foreign direct investment. Italian private sector R&D expenditures is 43% of overall expenditures, in comparison USA and other EU countries – 66%. Large companies with at least 500 members spend approximately 80%, but Italian private sector it is for the most part small and medium size companies. Italian large companies import technologies and receive subsidy from government.

Related and Supporting Industries. Italy has been successful in developing a number of vibrant clusters, in such areas as production technology, apparel, textiles, footwear, furniture, construction materials. Hospitality and Tourism is still one of Italy ’s largest clusters. Strong figures of local supplier quantity and quality, local availability of research and training services favour further cluster development.

Therefore, Italian industrial districts have innovated successfully without basic R&D, available capital and strong university – industry relations, but the current competitive environment suggests the changes ought to take place to minimize the gap between a well-developed & flexible regional innovation network and under-developed capital markets and other factors that affects the ability of firms to grow and to receive R&D investments. Significant cultural and institutional changes in education, training, labour and financing should be made to improve conditions for developing tourism cluster.

The list of references:

1. Michael E. Porter, The Competitive Advantage of Nations. – New York : Free Press, 1990.

2. BLS Information. Glossary. U.S. Bureau of Labor Statistics Division of Information Services. February 28, 2008. Retrieved 2009-05-05 [Web resource]. – Access mode: http://en.wikipedia.org/wiki/Comparative_advantage

3. Business Competitiveness Index [Web resource]. – Access mode: http://www.weforum.org/issues/global-competitiveness

4. Comparative advantage [Web resource]. – Access mode: http :// www . wto . org / english / res _ e / reser _ e / cadv _ e . htm

5. Doing Business in Italy [Web resource]. – Access mode: http://www.doingbusiness.org/data/exploreeconomies/italy

6. GDP rate of Italy [Web resourse ]. – Access mode: http://www.tradingeconomics.com/

7. Global Competitiveness Report 2008-2009. [Web resourse ]. – Access mode: https://members.weforum.org/pdf/GCR08/GCR08.pdf